Maintaining accurate records lies at the heart of successful Forex trading. Traders who adopt a systematic approach to document every transaction, decision and outcome gain a clear edge over their peers. Beyond mere bookkeeping, detailed logs foster discipline, enhance analytics and support continuous improvement of strategies. The following sections explore why meticulous record-keeping is vital, what data points matter most, and how to implement efficient systems for tracking and reviewing trading activity.

Why Comprehensive Record-Keeping Matters

Keeping a thorough journal of Forex trades goes far beyond ensuring regulatory compliance. It serves as a feedback loop that reveals strengths, weaknesses and hidden patterns. Below are key advantages of maintaining robust records:

- Enhanced transparency into decision-making processes, reducing emotional bias.

- Objective performance evaluation, helping traders pinpoint which strategies deliver consistent returns.

- Quick identification of recurring risk exposures and opportunities to adjust leverage or position sizing.

- Facilitation of tax calculations and audits, ensuring accurate reporting of gains and losses.

- Improved accountability, motivating adherence to trading plans and risk-management rules.

Traders often underestimate how small oversights, such as missing a spread cost or ignoring rollover fees, can erode long-term profitability. A disciplined record-keeping routine brings every hidden expense to light, boosting overall efficiency of portfolio management.

Key Data Points to Track in Forex Trading

Every successful trading journal includes a standardized set of metrics. These data points form the building blocks for actionable insights:

Trade Details

- Entry and exit times (date, hour and minute) for precise time-cycle analysis.

- Currency pairs involved and direction of the trade (buy/sell).

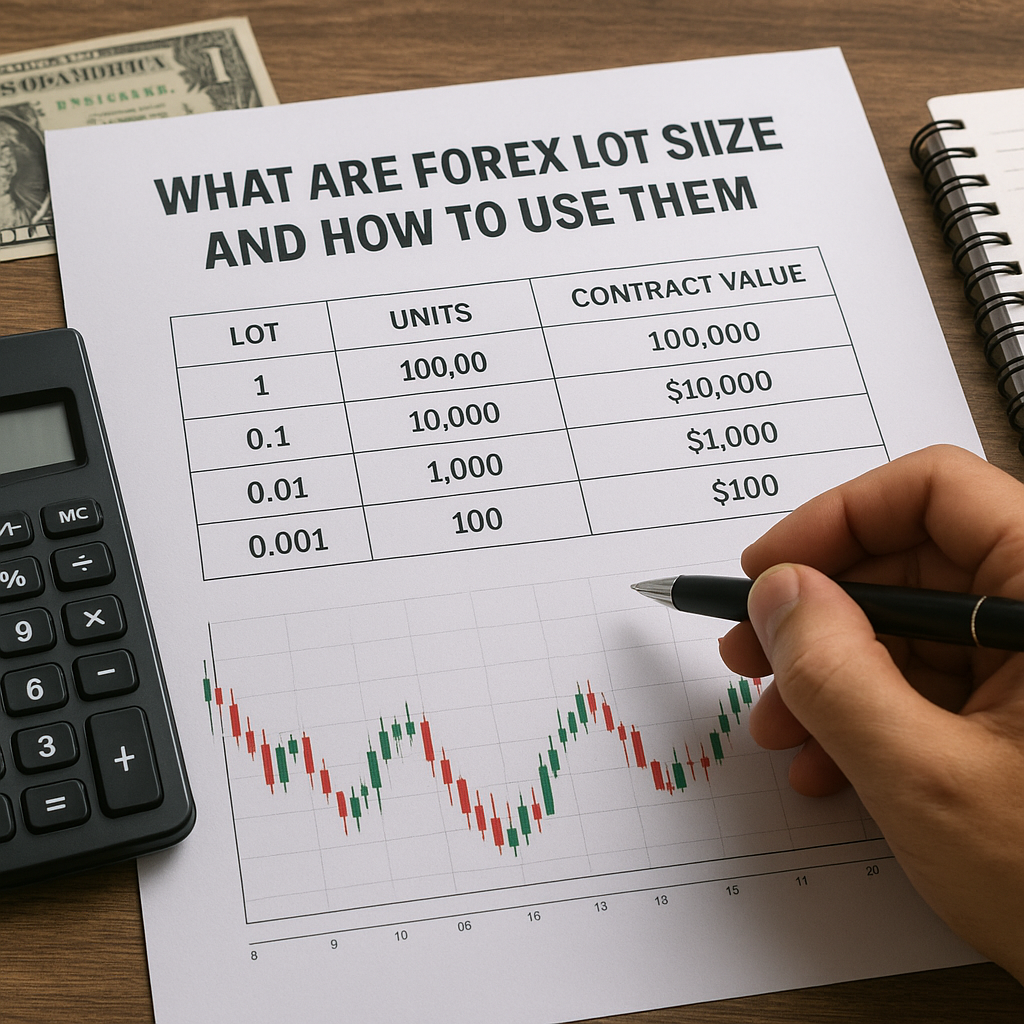

- Position size and leverage used, revealing risk concentration.

- Entry price, exit price and net profit or loss per trade.

Risk-Management Metrics

- Stop-loss and take-profit levels, indicating risk-reward ratios.

- Maximum drawdown experienced during each trade and overall.

- Percentage of account equity risked per position.

Qualitative Observations

- Market conditions (trend, range, volatility) at trade initiation.

- Economic events or news releases that influenced entry or exit.

- Emotional state and adherence to the trading plan (e.g., fear, greed).

Documenting both quantitative and qualitative aspects equips traders to discern whether performance fluctuations arise from technical shortcomings or external market forces. Over time, patterns emerge that sharpen strategy refinement.

Implementing Effective Record-Keeping Systems

While manual notebooks still hold value, the modern trader demands digital solutions for speed and scalability. Consider these tools and practices:

- Spreadsheets with pre-built formulas to auto-calculate key ratios and statistics.

- Specialized journaling software designed for Forex, supporting chart snapshots and trade tagging.

- Cloud-based platforms that enable real-time updates across multiple devices.

- Automation scripts or API integrations that pull trade data directly from brokers.

Integrating automated data capture eliminates time-consuming manual entry, allowing traders to focus on analysis. Coupling this with periodic backups and encrypted storage ensures data accountability and security.

Best Practices and Common Pitfalls

A robust record-keeping framework demands consistency and regular review. Keep these best practices in mind:

- Log trades immediately after execution to avoid forgotten details.

- Schedule weekly or monthly analysis sessions to identify emerging trends.

- Use visual aids, such as equity curve charts and heat maps, to spot anomalies.

- Standardize entry fields to prevent inconsistent terminology and data gaps.

- Archive older records in a separate repository to maintain journal performance.

Common mistakes include neglecting to note trading costs like spreads and swaps, underrepresenting position sizes, or skipping analysis of losing trades. Such gaps can skew results and erode confidence over time. By enforcing a uniform template and leveraging digital tools, traders safeguard the integrity of their data and pave the way for sustainable growth in the highly competitive Forex market.